SMS Opt-In Policy

Your Trusted Insurance Advisor

SMS Terms of use

Alta Vista Insurance Agency

TEXT MESSAGING TERMS OF USE

By "Opting In" to or using a “Text Message Service” (as defined below) from Alta Vista Insurance Agency, you accept these Terms & Conditions. This agreement is between you and Alta Vista Insurance Agency or one of its affiliates. All references to "Alta Vista Insurance Agency," "we," "our," or "us" refer to Alta Vista Insurance Agency, 2585 Pio Pico Dr, Carlsbad CA 92008.

DEFINITIONS

"Opting In," "Opt In," and "Opt-In" refer to requesting, joining, agreeing to, enrolling in, signing up for, acknowledging, responding to, or otherwise consenting to receive one or more text messages. "Text Message Service" includes any arrangement or situation in which we send one or more messages addressed to your mobile phone number, including text messages (such as SMS, MMS, or successor protocols or technologies).

CONSENTING TO TEXT MESSAGING

By consenting to receive text messages from us, you agreed to these Text Messaging Terms and Conditions, as well as our general terms and conditions and Privacy Policy , incorporated herein by reference.

E-SIGN DISCLOSURE

By agreeing to receive text messages, you also consent to the use of an electronic record to document your agreement. You may withdraw your consent to the use of the electronic record by replying STOP.

Alta Vista Insurance Agency

TEXT MESSAGE SERVICE PRIVACY POLICY

We respect your privacy. We only use information you provide through this service to transmit your mobile messages and respond to you. This includes, but isn't limited to, sharing information with platform providers, phone companies, and other vendors who assist us in the delivery of mobile messages.

WE DON'T SELL, RENT, LOAN, TRADE, LEASE, OR OTHERWISE TRANSFER FOR PROFIT ANY PHONE NUMBERS OR CUSTOMER INFORMATION COLLECTED THROUGH THE SERVICE TO ANY THIRD PARTY.

Nonetheless, we reserve the right always to disclose any information as necessary to satisfy any law, regulation or governmental request, to avoid liability, or to protect our rights or property. This Text Message Service Privacy Policy applies to your use of the Text Message Service and isn't intended to modify our general [“Privacy Policy” OR RELEVANT NAME OF PRIVACY POLICY REFERENCED IN SECTION ABOVE], incorporated by reference above, which may govern the relationship between you and us in other contexts.

COSTS OF TEXT MESSAGES

We do not charge you for the messages you send and receive via this text message service. But message and data rates may apply, so depending on your plan with your wireless or other applicable provider, you may be charged by your carrier or other applicable provider.

FREQUENCY OF TEXT MESSAGES

This Text Messaging Service is for conversational person-to-person communication between you and our employees. We may send you an initial message providing details about the service. After that, the number of text messages you receive will vary depending on how you use our services and whether you take steps to generate more text messages from us (such as by sending a HELP request).

OPTING OUT OF TEXT MESSAGES

If you no longer want to receive text messages, you may reply to any text message with STOP, QUIT, END, REVOKE, OPT OUT, CANCEL, or UNSUBSCRIBE. As a person-to-person communication service, opt-out requests are specific to each conversation between you and one of our employees and their associated phone number. After unsubscribing, we may send you confirmation of your opt-out via text message.

CONTACT US

For support, contact us at

[email protected]

760-724-2124

Mail: PO BOX 1480 Vista CA 92085-1480

Physical: 2585 Pio Pico Drive, Ste 100, Carlsbad CA 92008

Alta Vista Insurance Agency SMS Text Message Opt-In Policy

You are not required to opt-in to SMS text messaging to receive our services.

Prior to sending you the first SMS Text message, Alta Vista Insurance Agency must obtain agreement from you to communicate with you via SMS Text message - this is referred to as "consent", we must make it clear to you, the individual that you are agreeing to receive messages of the type we are going to send you. We keep a record of the consent, in our database with the date, time-stamp, and your opt-in status to receive SMS text messages from us. You have a right to that document by making a written request to us, or by calling us and requesting a copy of that document.

By opting in to receive SMS text messages from Alta Vista

Insurance Agency, you consent to receive updates, notifications, and

promotional offers related to your request for an appointment, insurance quotes, insurance policy documents you may request and policy notifications.

The frequency of the SMS messages you receive may vary based on your interactions with us. These messages may include appointment confirmations, payment reminders, updates about your insurance policy, and promotional offers.

Opt-In Process

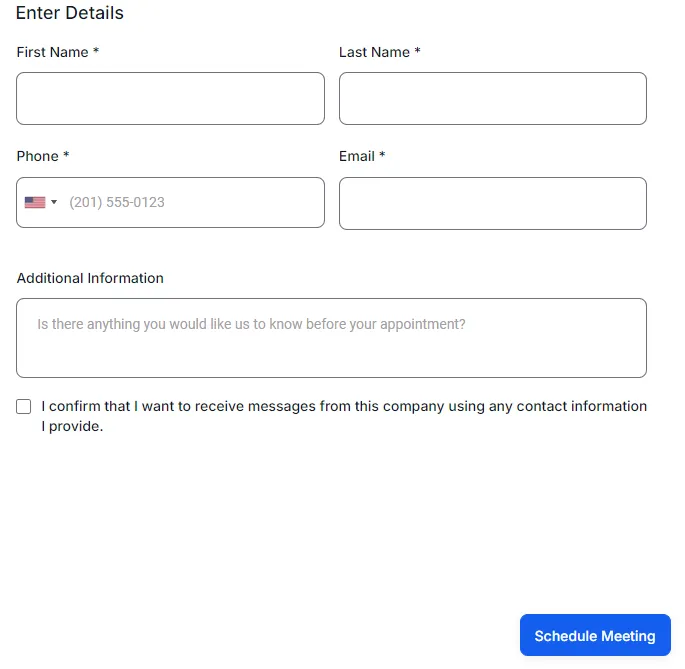

When you book an appointment with one of our agents, or when you make an online request for service on one of your policies we service, you will have the option to "opt-in" to receive SMS text messages from us by clicking the check box (see the form example below)

If you do not check the box "I confirm that I want to receive messages from this company using any contact information I provide." you will not receive any SMS text messages from us. Again, you are not required to opt-in to receive SMS text messages from us as a condition of using our services. The check box is unchecked by default. You must check it to opt-in to receive SMS text messages from us.

Message & Data Rates: Standard message and data rates may apply.

Opt-Out Instructions

There are two ways you can opt-out to stop receiving SMS messages from us:

You have the right to revoke consent at any time by replying with the standard opt-out keyword "STOP". When you opt out, we may deliver one final message to confirm that the opt-out has been processed, but any subsequent messages will not be sent, and your number will be removed from our SMS distribution list promptly.

Additionally, you can also opt out by calling our customer support team and requesting for your number to be removed from future SMS communications.

Once you have Opt-Out of receiving SMS messages from us, you must once again provide consent before we can send any additional messages. (See Opt-In Instructions above)

Data Use and Privacy

Your phone number will be used solely for the purposes of providing updates, notifications, and promotional information related to your insurance policy with Alta Vista Insurance Agency. We do not sell or share your information with third parties. Your data will be handled with the highest level of confidentiality. Your privacy is important to us. We do not share your personal information with third parties. For more details, please review our Privacy Policy.

If you have any questions or need further information about this policy or your data, please contact us directly.

Thank you for choosing Alta Vista Insurance Agency!

OUR SERVICES

We Also Offer

Accident Forgiveness Programs

These programs offer a layer of protection by ensuring that a single at-fault accident does not result in an increase in your insurance premiums. In essence, they grant you a second chance, acknowledging that accidents can happen to even the most careful drivers.

Key Replacement Coverage

In the hustle and bustle of modern life, it's all too easy to misplace or lose your car keys, and the cost of replacing them can be unexpectedly high. Key Replacement Coverage steps in to ease this burden by covering the expenses associated with getting new keys, whether they're traditional or high-tech smart keys.

Custom Parts and Accessories Coverage

When you've poured time and resources into upgrading your car with aftermarket parts or unique accessories, standard insurance coverage may fall short in adequately protecting these additions. This specialized coverage steps in to ensure that your customizations are safeguarded in the event of theft.

Low-Mileage Discounts

These discounts acknowledge the reduced risk associated with driving fewer miles and are a testament to the fact that some individuals use their vehicles sparingly. By actively encouraging policyholders to limit their time on the road.

TESTIMONIALS

CUSTOMER REVIEWS

When I was involved in a car accident last year, I was overwhelmed and didn't know where to turn. That's when I realized the true value of [Your Auto Insurance Agency]. From the moment I called their 24/7 support line, I felt reassured.

JOHN DOE

I've been a loyal customer of [Your Auto Insurance Agency] for over a decade, and they've consistently exceeded my expectations. Not only do they offer competitive rates, but their commitment to personalized service is exceptional.

JOHN DOE

OUR TEAM

John Doe

David Doe

Jane Doe

Get In Touch

Email: [email protected]

Address Office: 2585 Pio Pico Drive, Carlsbad CA 92008

Assistance Hours:

Mon – Sat 9:00am

Sunday – 8:00pm

FAQS

What factors affect my auto insurance premium?

Your auto insurance premium is determined by a combination of factors, including your driving history, the type of coverage you select, the make and model of your vehicle, your location, and even your credit score. Safer drivers with clean records typically pay lower premiums, while high-risk drivers may face higher rates. The specific details can vary between insurance companies, so it's essential to discuss your unique circumstances with one of our experienced agents to get an accurate quote tailored to your needs.

Can I add additional drivers to my auto insurance policy?

Yes, you can usually add additional drivers to your auto insurance policy. This can include family members, friends, or other individuals who regularly drive your vehicle. However, it's essential to provide accurate information about all drivers and their driving history when adding them to your policy.Keep in mind that adding drivers with a poor driving record or a history of accidents may increase your insurance premium. Conversely, adding experienced, safe drivers can sometimes lead to lower rates.

What happens if I let someone borrow my car, and they have an accident?

If you lend your car to someone and they have an accident, typically your auto insurance policy would be the primary coverage in most cases. Insurance typically follows the car, not the driver. So, your insurance would likely be responsible for covering the damages to your vehicle and any liability associated with the accident.However, it's essential to check your policy and consult with your insurance provider because coverage can vary. Some policies may exclude certain drivers or have restrictions on who can use your vehicle. Additionally, if the person borrowing your car has their own auto insurance, their policy might provide secondary coverage.